[ad_1]

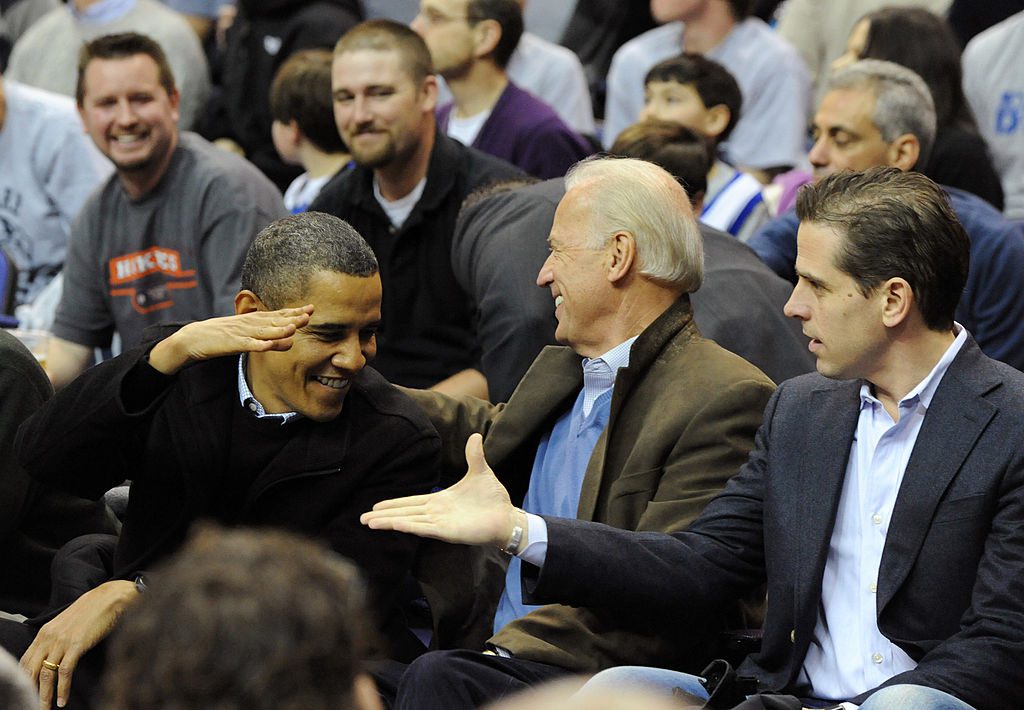

(Photo by Alexis C. Glenn-Pool/Getty Images)

Well, it came a little later than most people expected, but Hunter Biden’s colorful resume has turned into a campaign issue after all. The New York Post‘s bombshell report last week—evidence that Hunter, as was long suspected, had capitalized on access to his VP father while serving on the board of a Ukrainian energy company—is likely to hurt Quid Pro Joe’s campaign in these final, crucial stages. What’s more, major online platforms’ blatant attempts to censor that reporting are sure to spark backlash among voters next month.

When they’re not openly running interference by blocking links to sourced exposés, powerful media and cultural institutions rely on simple spin to aid the Biden campaign. The prodigal son’s misdeeds—from influence-peddling to crack-smoking to paternity disputes—are cast as youthful indiscretions. What this generous bit of gaslighting invites us to forget is that Hunter Biden is not some twenty-something screwup just trying to find his way—Hunter Biden is 50 years old, with a long, established track record of ethical violations stretching back over much of that half-century. Burisma is just one episode in a protracted saga of apparent corruption and cover-ups. Let’s look back on the beginnings of the pattern.

In the last years of the last millennium a 26-year-old Hunter Biden, fresh out of Yale Law and the son of a 24-year-incumbent U.S. senator, got a gig as deputy campaign manager for his dad’s reelection bid, and also took a cushy job at a bank holding company that happened to be one of his father’s biggest campaign funders. After less than three years there—in which he managed to become the company’s executive vice president—Hunter headed to the U.S. Department of Commerce for the last 3 years of the Clinton administration, hired on the orders of Commerce Secretary William Daley (who happened to have worked on Joe’s first presidential campaign). As Clinton was about to leave office, Hunter left government and turned to lobbying—becoming, as Brian Anderson observed here at TAC, “an expert in copyright enforcement, Ukrainian geopolitics, and other complex policy issues at precisely the same moment that his father began to oversee them in government.” (He was hired on to a skyrocketing startup firm by cofounder William Oldaker—another Biden ’88 adviser.)

In 2006, it was time for Hunter to get out of lobbying. (The fact that Joe once again had his eyes set on the White House may well have influenced this decision.) Joe’s younger brother, James stepped in to help. James has been more successful and more audacious even than Hunter in cashing in on family ties. In one incident, James joined construction giant HillStone International as executive vice president 3 weeks before the firm snagged a $1.5 billion contract to rebuild houses in war-torn Iraq while Joe was in the White House helping wage the war. (James had no previous experience in the construction business.) He was, in many ways, the perfect mentor for Hunter.

Given the Biden family’s humble, middle-class character—so proudly touted on the campaign trail—the obvious career move was to buy a hedge fund. James brokered the deal, and by year’s end he, Hunter, and a third partner named Anthony Lotito had bought Paradigm Global Advisors, a fund of funds. Hunter was installed as CEO. The deal was reported on extensively in 2009 by finance blogger John Hempton, who had noticed some oddities and discrepancies in a number of documents related to PGA. That’s a bit of an understatement: virtually every aspect of the fund, and of the process by which it came into the Bidens’ possession, raises serious concerns.

For one thing, Hunter and James seem to have done no due diligence regarding their business partner, or the lawyer he brought on board. It became apparent that Lotito was scamming them—which James readily admitted in a sworn affidavit in the spring of 2007—as was the lawyer, John Fasciana. The affidavit is almost comical in its professed naivety. For instance:

Lotito failed to inform Hunter or me that Fasicana: (1) had been convicted in federal court of participating in a scheme to steal hundreds of thousands of dollars and to launder that money through his attorney trust account; (2) had exhausted all his appeals; and (3) was merely awaiting sentencing for his crimes.

Had we known of Fasciana’s conviction and prior criminal conduct, we would not have retained Fasciana for any purpose. We also would not have formed LLB [the holding company the three partners used to buy PGA], and would not have engaged in any further business dealings with Lotito.

Nor were the personnel problems limited to the Bidens’ business partners. At the fund itself, founder James Park, JD, PhD, who was primarily responsible for the fund’s management, was known to have a serious substance abuse problem and to have been an absentee manager for several years. (Dr. Park has now left the hedge fund game, and wears a number of different hats, including that age-old magnet for the virtuous and good: college admissions consultant.)

It’s hard to believe that any of these things would have been very difficult to find out. One would think that, say, making sure your lawyer is not a convicted felon awaiting sentencing would be the absolute bare minimum required of due diligence in acquiring a hedge fund comprising $1.5 billion in assets. Ditto on the drug-addicted deadbeat boss.

Well, there’s another of the problems with PGA. As it turns out, Hunter and James weren’t acquiring a hedge fund comprising $1.5 billion in assets—it was actually somewhere between $200-300 million. This raises a host of other issues. As Hempton has pointed out, for instance, there is no way PGA in 2006 could have supported its professed 28 employees, on three continents, with the meager revenue from these investments—probably netting less than $3 million annually when all was said and done. Whether any fraud was perpetrated on the clients before or during the Bidens’ tenure is unclear. What is certain is that James and Hunter made a massive, easily avoidable mistake.

The concerns only multiply from there. Hempton also uncovered troubling ties between PGA and Ponta Negra, a suspicious hedge fund (i.e. Ponzi scheme) whose manager later pled guilty to fraud charges. Among the things shared by PGA and Ponta Negra are, at the very least: an address, a phone number, and a marketer. The Bidens have maintained that Ponta Negra were merely subtenants, introduced through the shared marketer (who also has “a history of marketing what [Hempton] politely deems ‘scuzzy product’”). Nor is Ponta Negra the only Ponzi scheme in PGA’s orbit: after the Biden acquisition, PGA was reported by The Wall Street Journal to have collaborated on a fund with notorious fraudster Allen Stanford.

Hunter didn’t last long as CEO, likely due to a rude awakening on what he had gotten himself into, but he and James maintained ownership of PGA at least as late as 2009. Exactly how Hunter managed to extricate himself from the PGA imbroglio (and land on the board of one of Ukraine’s largest energy companies) is not entirely clear. We do know how he defrayed the debt accrued in the process: with a small loan of a million dollars, leveraged against his house. If that seems like a generous sum, it may have something to do with the fact that Washington First Bank, which provided the note, was cofounded by one William Oldaker.

In the most generous possible reading of the situation, Hunter and James Biden—after years of capitalizing on their connection to Joe—fell for a massive scam, losing well over a million dollars in the process. That they managed to get out of hot water at all may well have been owed to their last name also. This assumes, again, the rather charitable concession that neither of them ever misrepresented the state of affairs at PGA, and that neither of them had any knowledge at all of the myriad shady dealings of multiple associates. Concede all that, and this is still a massive problem.

Assuming the Paradigm Global debacle is exactly what it looks like—the media’s habitual blind eye leaves us relying on an incomplete picture—then the biggest story of the Biden family hustle may not be their simple willingness to cash in on the name (this has been common knowledge for years) but just how easily and summarily certain Bidens can be taken for chumps. This would be, to say the least, a concerning background for the son and brother of a potential president of the United States—two men who will be sure to cash in on that position if it comes about (or at least to try).

The next time the Bidens get taken in, the stakes are likely to be much, much higher.

[ad_2]

Read the Original Article Here