[ad_1]

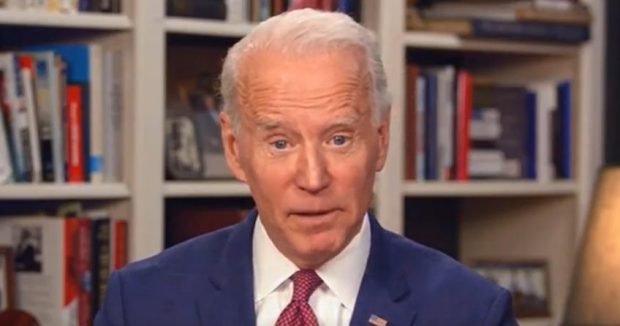

Assumed Democratic Presidential candidate Joe Biden has already promised to get rid of the Trump / GOP tax cut legislation of 2017. That tax cut package went into effect in 2018. Biden says that the tax cuts went overwhelmingly to the wealthy. He further says that the tax cuts added $2 trillion to the Federal debt.

Biden’s claim about the effect of the tax cuts on the public debt is supported by Congress’ Joint Committee on Taxation, although they say the real figure is $1.5 trillion. The reality is that both Congress and Biden are completely wrong.

The Trump / GOP tax cut did not add one penny to the deficit or the public debt. Let me repeat that. The Trump tax cut did not add one penny to the deficit or the debt.

Tax revenue increased after the Trump / GOP tax cut.

In 2017, the Federal government collected $3.32 trillion in tax revenue. In 2018, the first year of the tax cut, the Federal government collected $3.33 trillion, a slight increase over 2017. Next, in 2019, the total collected was $3.46 trillion. In fact, in every year after the Trump / GOP tax cut, tax revenue increased. It did not decrease.

Therefore, since the tax cuts ended up increasing tax revenue, they did not add one penny to the deficit. Why, then, do Biden and Congress say that exactly the opposite? As noted, they claim the debt increased significantly because of the tax cut. But it has not.

Biden claims that if the income in 2018 had been taxed at the higher pre-tax cut rate, tax revenue would have been $150 billion higher. So, for a ten year period, that would amount to $1.5 trillion. But his argument is based on faulty assumptions.

Without the tax cut, less income would likely have been generated. Without the tax cut, the economy may have slid into recession. So, even though the rate may have been higher without the tax cut, total revenue would likely have been much lower.

A simple example.

As a simple example, suppose total income is $1,000 and the tax rate is 10%. That means $100 in tax revenue would have been collected. Suppose the next year, the tax rate is cut to 9%. The increased disposable income for consumers and the larger corporate profits would lead to an increase in economic activity. The total income increases to $1,200.

A 9% tax rate on income of $1,200 generates $108 in tax revenue. This amounts to an increase over the $100 collected prior to the tax cut. And that’s what happened with the Trump / GOP tax cut. Tax rates went down. But total income went up, so tax revenue actually increased. Since tax revenue did not decrease, the tax cut did not add one penny to the deficit.

(Article Continues Below Advertisement)

Biden and Congress continue to argue that if Trump and the GOP did not cut the tax rate 10% to 9%, tax revenue would have totaled $120 ( $1,200 times 10%). The underlying and incorrect assumption here is that income would have increased to $1,200 without the tax cut. The reality is that without the tax cut, income may have fallen or at least not increased nearly as much as it did. So actual tax revenue without the tax cut could have been much lower.

Trump’s policies stimulate the economy. They do not add to the Federal debt

The numbers in these simple examples show what actually happened. In this as in most things politicians claim to project, we must remember one thing. Projections are just projections. They are only based on assumptions that may or may not prove accurate in the real world.

The bottom line: Trump’s twin policies of removing burdensome and counter-productive regulations, coupled with tax cuts for all taxpayers, resulted in increased economic activity and higher tax revenues. That’s why the Trump / GOP tax cut worked and continues to work. This legislation did not add to the Federal debt.

But the Trump / GOP tax cuts were only for the wealthy, right?

The other biased claim Biden makes against the Trump / GOP tax cuts is that the cuts and their benefits went overwhelming lyto the wealthy. The reality is that the tax cuts went out proportionately to all taxpayers. The tax cut reduced all taxpayers’ liability by approximately 10%. Trump insisted on this.

However, if a household did not pay any Federal income tax, they could not possibly have benefitted from any tax cut. Data shows that 44% of US households paid no Federal income tax in the year following enactment of the tax cut. Therefore, the government cannot cut their taxes because they don’t pay any. So, technically, they received no benefit. Except that they did receive the benefit of paying no taxes at all.

If a wealthy taxpayer pays $50,000 in taxes, a 10% cut would yield $5,000 in savings. If a taxpayer paid $5,000 in taxes, the tax cut was $500. Yes, the wealthy taxpayer received a tax cut 10 times larger in dollars than other taxpayers. But the reason for that is because the wealthier taxpayer routinely pays 10 times more in taxes.

Let’s keep America’s tax rates low

If Biden wins the presidential election and reverses the Trump / GOP tax cuts, the US economy will slow down, total income will fall (or at least grow very slowly) and the economy will return to the Obama / Biden era of economic stagnation. As a result, once again, tax revenue may actually decrease.

Lower tax rates and less regulation routinely produces a more robust economy with more opportunity for all well-prepared Americans. Neither adds to the Federal debt.

Best advice for our elected representatives? Keep US tax rates as low as possible.

Wake up Right! Subscribe to our Morning Briefing and get the news delivered to your inbox before breakfast!

Sponsored Content

[ad_2]

Read the Original Article Here